We partnered with a prominent American B2B funding platform to enhance their organic search performance across the highly competitive US market. Initially, the platform struggled with ranking for high-intent financial keywords, resulting in low conversion volumes despite a large market opportunity. Therefore, we executed a detailed strategy focusing on website hierarchy restructuring, comprehensive content depth, and precise on-page optimization. After all, the result was transformative, delivering significant growth in both traffic and qualified submissions.

💼 Client: U.S. B2B Funding Platform (name withheld)

👔 Agency: O2 Digital Agency

📅 Period: 12 Months

✅ Organic Leads: 340% growth

✅ Organic Sessions: 173.1% growth

Key Results at a Glance

Within 12 months, we established the platform as an authority, leading to measurable commercial success:

- Organic Qualified Leads Surged: 340.00% growth.

- Total Organic Sessions Increased: 173.10% growth.

- Top 10 Keyword Rankings Improved: 142.48% increase in keywords ranking in positions 1–10.

- Core Keyword Visibility Elevated: Average organic search position improved by 11.8 positions.

- Organic Conversion Rate: 91.46% improvement, shifting from 0.82% to 1.57%, indicating higher quality, targeted traffic.

The B2B Funding Landscape

The digital B2B payments and lending market in the United States continues its trajectory of accelerated growth. We observe businesses increasingly seeking streamlined, digital solutions for obtaining capital, bypassing the complexities often associated with traditional financial institutions. This environment favors digital funding platforms that can connect businesses, especially small to mid-sized enterprises, with diverse financial products quickly and transparently. Consequently, the digital financing sector is expanding rapidly, with market projections indicating significant continued growth over the next decade.

Growing Opportunities in Digital Finance

Technological advancements, particularly the integration of automation and data aggregation, are revolutionizing how B2B funding platforms operate. These platforms are perfectly positioned to capitalize on the demand for rapid loan origination and sophisticated credit assessment tools. Moreover, the long and complex B2B sales cycle means that buyers conduct extensive research online before ever speaking to a representative. Nonetheless, platforms that publish deep, authoritative, and structured content addressing specific financial hurdles gain a significant competitive edge. We recognized that establishing true expertise through content would capture intent across all stages of the business’s lending journey.

The Client’s Initial Difficulties in a Competitive Market

Our client is a robust platform that successfully bridges the gap between businesses needing loans and the institutions providing them. However, they faced several core digital difficulties when we began our collaboration:

- Shallow Site Structure: Their website structure lacked the hierarchical depth required to communicate authority across various loan types and regional regulations.

- Unfocused Content Strategy: The existing content strategy relied too heavily on general terms, neglecting the specific long-tail questions that finance controllers and CEOs use during their research.

- Fragmented On-Page SEO: The existing on-page optimization was fragmented, failing to clearly signal the relevance and topical breadth of their services to search engines.

The combination of structural limitations and unfocused content prevented them from competing effectively against established financial giants and agile FinTech startups alike.

Our Diagnosis and Strategic Roadmap

We initiated the process with an in-depth, surgical SEO audit. The audit confirmed that the technical foundation was sound, but the content architecture needed a complete overhaul. Therefore, our primary strategic goal was to establish the platform as the definitive authority in B2B funding options across the US.

Our agreed-upon strategy included three core pillars:

- Hierarchy Rebuilding: We aimed to map the site structure to the user’s decision journey, creating distinct content clusters for different financial products (e.g., equipment financing, short-term loans, lines of credit) and specific industry needs.

- Expert Content Deepening: We planned to enrich existing high-value pages and introduce new, data-driven content, FAQs, and comparison guides that featured real human expertise and addressed complex regulatory and credit risk challenges.

- Precise On-Page Optimization: We would implement granular optimization across all major pages, ensuring that H-tag structure, internal linking, and meta-data accurately reflected the high commercial intent of the target keywords.

Executing the Targeted Action Plan

We moved quickly to execute the plan, focusing entirely on aspects within the client’s existing infrastructure:

Information Architecture and Structure

- Restructuring the Information Architecture: We mapped out and implemented a new structure, creating clear pathways from top-level category pages to detailed resource hubs and individual financing options. This significantly improved both crawlability and user experience.

Content and Expertise (E-E-A-T)

- Developing User-Centric Content: We collaborated closely with their subject matter experts to create highly specific content addressing user pain points, such as “How to qualify for a $50,000 short-term B2B loan” or “Comparing asset-based lending rates for manufacturing.”

- Implementing Advanced FAQ Schema: We developed and applied detailed, specialized FAQ schema markup to service pages and key content pieces. This ensured their valuable Q&A content was prioritized and surfaced directly in search results, capturing immediate attention.

Conversion Optimization

- Optimizing Conversion Pathways: We fine-tuned the on-page elements surrounding the Call-to-Action (CTA) buttons on conversion pages. This was achieved through clearer value propositions and internal anchor text linking from supporting content, increasing lead quality.

Detailed 12-Month Performance Metrics

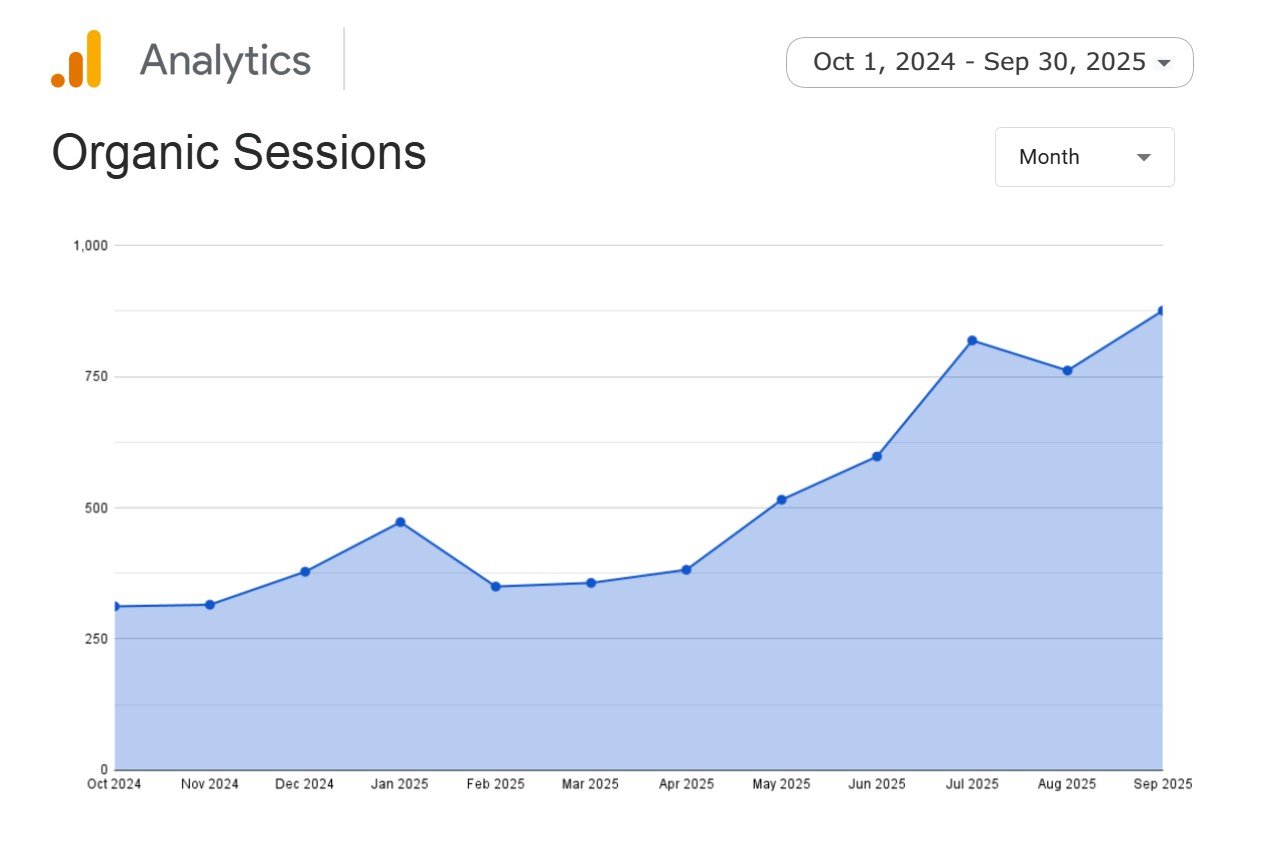

The focused application of on-page and content strategy yielded substantial growth within the first year:

- Organic Qualified Leads Surged: 340.00% growth, increasing from 5 to 22 submissions per month.

- Total Organic Sessions Increased: 173.10% growth, moving from 316 to 863 sessions.

- Top 10 Keyword Rankings Improved: 142.48% increase in keywords ranking in positions 1–10 (from 113 to 274).

- Core Keyword Visibility Elevated: Average organic search position improved by 11.8 positions, moving from an average rank of 18.1 to 6.3.

- Organic Conversion Rate Grew: 91.46% improvement, shifting from 0.82% to 1.57%, indicating higher quality, targeted traffic.

Partner with O2 Digital Agency for Sustainable Growth

We understand that sustainable digital growth for B2B FinTech platforms demands precision, authority, and relentless focus on the user’s intent. Therefore, these results clearly show how foundational SEO improvements in content and hierarchy can unlock massive commercial potential, even in highly regulated and competitive sectors. Still, achieving a 340% growth in qualified organic leads is a testament to the fact that detailed strategy always outperforms generic efforts. We operate internationally, serving clients like this one across the US, UK, Canada, Australia, and the UAE, providing world-class SEO services, social media marketing, and website development. However, we always start with the user and the search engine, building a strategy tailored to your business needs.

Let’s map your next 12 months. Book a consultation with O2 Digital Agency and we’ll tailor the strategy, forecast the outcomes, and get your pipeline moving.